January 29, 2025

Stock markets are experiencing a strong post-election rally, driven by investor optimism, policy expectations, and economic growth prospects. Will the momentum continue

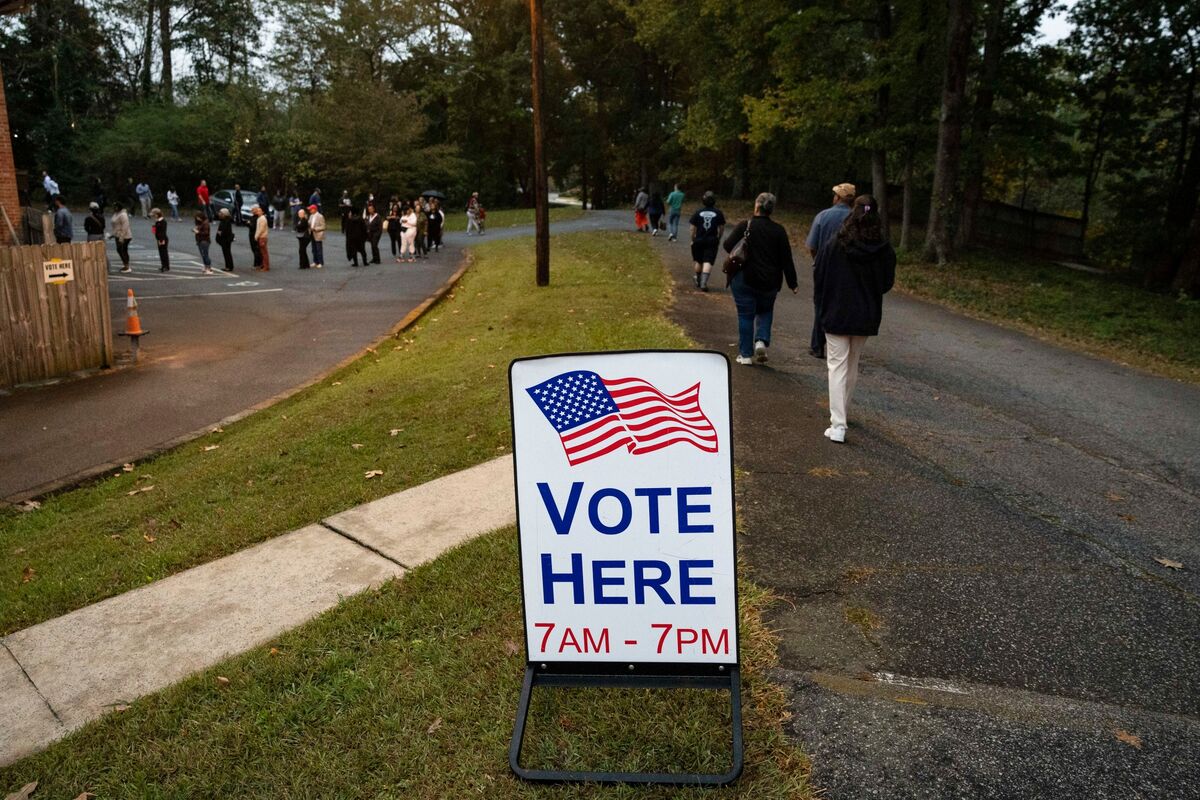

Stock markets often react strongly to political events, and elections are among the most significant drivers of investor sentiment. As the dust settles from the latest U.S. election, markets have responded with a surge in optimism, sending stocks higher in what analysts call an "election rally."

This rally is driven by several factors, including policy expectations, economic outlook, and investor sentiment. But can this momentum last? In this article, we explore the key reasons why the election rally could continue and what investors should watch for in the coming months.

An election rally refers to a period of stock market gains following an election. Historically, markets tend to perform well in the aftermath of a major political event, particularly when there is clarity on leadership and economic policies.

The reasons behind election-driven market rallies include:

Now, let’s look at the key reasons why this election rally could sustain its momentum.

One of the primary reasons for the rally is the anticipation of pro-business economic policies. Depending on the party in power, investors may expect:

Investors are carefully analyzing policy proposals to determine their potential impact on corporate earnings and economic growth. If these policies materialize, markets could see sustained gains.

Corporate earnings are a fundamental driver of stock prices. Despite economic uncertainties, many companies have reported better-than-expected earnings, fueling investor confidence. Key factors include:

If corporate earnings continue to impress, the stock market rally could extend well into the following months.

The role of the Federal Reserve in shaping market sentiment cannot be overstated. Interest rates, inflation, and monetary policies directly impact stock prices. Investors are hopeful that:

Traders are closely monitoring the Fed’s policy signals, and any indication of rate cuts could send markets soaring even further.

During election periods, government spending often increases, leading to higher liquidity in the financial system. Some contributing factors include:

As long as liquidity remains high, financial markets could continue their upward trajectory.

Looking at historical data, stock markets tend to perform well after elections. Over the past several decades:

While past performance does not guarantee future results, history suggests that the rally could persist if economic conditions remain favorable.

The U.S. stock market is not the only one experiencing gains. Global investors are also fueling the rally due to:

If global markets continue to reflect positive sentiment, the election rally could see further upside.

Despite the optimism, there are some risks investors should be aware of:

While these risks exist, careful market analysis and diversification strategies can help investors navigate potential challenges